2017 August Newsletter

The wattle is beginning to bloom, a sure sign that spring is just around the corner. The Australian economy has been a bit slower to spring to life, but there are some green shoots.

Australian consumers had a new spring in their step as July progressed thanks to a rising Aussie dollar, lower petrol prices and a jump in full-time employment. The ANZ/Roy Morgan consumer sentiment rating rose 2.3 per cent in the final week of July to its highest level in five months. While the unemployment rate held steady at 5.6 per cent in June, the growth in part-time jobs stalled as full-time jobs posted the biggest back-to-back monthly gains in 29 years. Inflation is also under control, with the June quarter CPI easing from 2.1 per cent to 1.9 per cent.This is below the Reserve Bank’s target band of 2-3 per cent, reducing the chance of a rise in official interest rates in the short-term. Petrol prices fell close to the $1 mark in many capital cities.

The Aussie dollar ended the month at a two-year high after pushing above the US80c level, which will please travellers but not our exporters. The rise reflects a weaker US dollar rather than any local economic issues. Earlier in the month Aussie businesses were brimming with confidence. The NAB business confidence index was up from +7.5 points to +9.3 points after the business conditions index reached a 9-year high.

What's really holding you back from your goals?

Everyone has goals they want to reach, whether they relate to work, family, lifestyle, or sport. But it seems like only a few people achieve what they set out to do. For the rest of us, success is always just out of reach. It’s got to the point where we joke with our friends and co-workers about how we’d be able to conquer the world if only we had a few more hours in the day. Or more energy. Or less responsibility at home. The list goes on…

Behind the jokes, though, feeling stuck in terms of progress can be frustrating and demoralising. On the flip side, finding a way around something you thought was impossible can feel spectacular. Here are some of the most common obstacles to success, and how you can tackle them.

1. Focusing on too many things at once

Multitasking sounds great in theory, but in practice spreading yourself thin over too many projects means you can’t give your all to, well, anything. Try this visualisation exercise for refocusing your goals: write down five of the pursuits you’re giving most of your energy to on five separate pieces of paper side by side. Then, try putting them in priority order of what’s most important to you. Think about the hours you spend on each thing and what you could do if you shifted your schedule so you spent the bulk of your time on priority no. 1. That doesn’t mean you can’t do everything you want – it just means you need to take it one step at a time.

2. Not mapping out your options

Have you ever heard someone say “I’d love to do (X, Y and Z), but it’s just impossible”? The truth is that ambition without planning is just daydreaming, but even the wildest of goals can be reached over time with a good strategy in place. If you feel like something you want is just out of the question, ask yourself: what’s the biggest obstacle in your way? And what can you do to remove that obstacle? For example, if you’d love to expand your business but you need financial backing or expert guidance, you could try looking in to innovative funding options, or networking your way towards a great mentor.

3. Relying on others for accountability

Some sources will tell you to make your goals public so that other people can hold you accountable. That sounds like a great idea, especially if you feel like you’ve already got problems with self-motivation. But what really happens is that you tell people what you’re aiming for and – like the good supportive friends and family they are – they encourage and cheer you on. In your brain, this registers as a reward, so you feel fulfilled even before you get started. Instead, try creating a system of self-accountability with effective incentives to keep you on track. Hint: it’ll probably work better if it involves positive reinforcement, rather than punishing yourself for perceived failures.

4. Not being consistent

Whether you’re writing the next great Aussie novel or developing a revolutionary new product, if you wait until you’ve got a jolt of inspiration and eight spare hours up your sleeve, you won’t get far. Instead, aim to do at least a little bit of work on your goal every day. Start by setting aside fifteen minutes a day (yes, every day) to work on your plan or project. Say for example you were trying to write something; even if you just write a paragraph and then decide later that you hate it, at least you’ll have explored an option and clarified your thought process.

So what are you waiting for? Take the first step today and turn your goals into reality.

Home ownership in the spotlight

Housing affordability continues to be a major concern in Australia and not just for would-be

The latest 2016 Census revealed a gradual decline in home ownership over the past decade from 68 per cent of all Australian households in 2006 to 65 per cent in 2016. And those of us with mortgages are more likely to be stretched to the limit, with over 7 per cent of home buyers paying more than 30 per cent of their income on mortgage costs.

It’s not only homeowners feeling the pinch. Rising house prices mean more of us are renting in the private market. Almost 25 per cent of households are renting privately, up from 21 per cent a decade ago; a further 4.2 per cent are in public housing. This puts upward pressure on private rents and increases demand for public housing.

Price growth easing

The national debate about housing affordability is understandably loudest in Sydney and Melbourne where the median price of houses and units is $880,000 and $675,000 respectively.i But residential property is always a tale of many markets.

While the constant warnings from some quarters that Australia’s housing boom is about to bust has not yet come to fruition, the rapid price growth of recent years appears to be slowing.

According to the CoreLogic Home Value Index, annual price growth eased from 12.9 per cent in March to 9.6 per cent by the end of June. In Perth and Darwin prices fell, while Brisbane and Adelaide posted modest gains. Hobart remains our most affordable capital city with a median price of $355,000 despite annual capital growth of 6.8 per cent.

Retiring with debt on the rise

The census also revealed that fewer of us own our homes outright. Mortgage-free home ownership is down from 32 per cent to 31 per cent over the same period. This could be due to more of us borrowing against the mortgage for renovations or investment, and higher home prices resulting in bigger mortgages that take longer to repay.

If this trend continues it could have implications for our retirement income system, which assumes that most people will retire with a home fully paid for. In a little over two decades the incidence of mortgage debt among people aged 55-64 has more than tripled from 14 per cent to 44 per cent.ii As more of us delay buying our first home until later in life, this trend is likely to continue.

To tackle housing issues at both ends of the age spectrum, the federal government announced some new measures in the May 2017 Budget.

New government incentives

The first of these is the First Home Super Saver Scheme. If the proposal is passed, first homebuyers will be able to make voluntary contributions of up to $15,000 a year to their super fund which they can withdraw to use towards a deposit, up to a maximum of $30,000.

In a move designed to free up more housing stock for young families, the Budget proposed allowing people over 65 to downsize and put up to $300,000 of the proceeds into super without it counting towards existing contribution caps. Couples could contribute up to $600,000. This may make downsizing more attractive for some, but it may not be the best strategy for everyone because the family home is exempt from the age pension assets test while super is not.

State governments have also stepped up assistance for first home buyers, with grants and stamp duty savings.

It remains to be seen whether these measures will significantly improve housing affordability for first home buyers or encourage Baby Boomers to downsize to a smaller nest.

Whatever your stage in life, we can work with you to help achieve your version of the Great Australian Dream.

i All housing prices from CoreLogic ‘Capital City Dwelling Values Rise 0.8% over June Quarter’ https://www.corelogic.com.au/news/capital-city-dwelling-values-rise-0-8-over-june-quarter

ii ‘Australians are working longer so they can pay off their mortgage debt’ http://theconversation.com/australians-are-working-longer-so-they-can-pay-off-their-mortgage-debt-79578

The risky business of cryptocurrency investment

There’s an estimated US$US100 billion worth of cryptocurrency floating around in cyberspace. In the real world, there’s a small but growing number of Bitcoin ATMs appearing in the world’s metropolises. Heavy hitters including Microsoft, Virgin Galactic and Expedia now accept Bitcoin as payment, in certain circumstances.

For those looking to turn a (tangible) dollar, investing in cryptocurrency has proven to be lucrative. If you’d bought US$100 worth of Bitcoin in 2009, it would now be worth more than US$70 million, but there have been some stomach-churning falls along the way.

Mining for cyber gold

In the late 1990s, when online transactions were becoming common, tech geniuses started musing about creating a new decentralised currency. A developer using the pseudonym ‘Satoshi Nakamoto’ made those dreams a reality by creating Bitcoin in 2009.

The way Bitcoin (and its 900 or so imitators) works is that individuals and groups must ‘mine’ it, much like digging for cybergold. Those who solve a complicated problem using mining software and high-powered computing hardware discover Bitcoins. They can then sell these bitcoins, or whatever the unit of cryptocurrency is, on online exchanges.

Like conventional currencies, cryptocurrencies can appreciate or depreciate. As noted, Bitcoin has appreciated spectacularly as has Ethereum, its one serious challenger, which has soared from just above US$8 to US$300 in the first six months of 2017.

So, what’s the catch?

By definition, cryptocurrencies are not legal tender backed by the full weight of a nation state and its central bank. That raises several issues.

First, there’s the practical matter of being able to spend your Bitcoins. As mentioned, some companies and even a handful of government organisations around the world now accept Bitcoins, Ethereum or other cryptocurrencies as payment but the majority don’t. Australia’s private and public sector organisations have remained particularly unenthused about embracing cryptocurrencies. Which is somewhat ironic given many believe ‘Satoshi Nakamoto’ is Australian.

Of course, you can exchange cryptocurrency for the old-school kind. But this will involve using an online exchange or, if you’re lucky, an ATM. There are hefty transaction fees involved and sometimes long waits for the transaction to be processed.

Regulators are yet to greenlight conventional investment products such as exchange-traded funds based on cryptocurrency, despite attempts by fund managers to do so. That doesn’t look like changing any time soon.

An investor seeking windfall profits in a low-return environment may be tempted to overlook all these inconveniences. But what can’t be overlooked is that cryptocurrencies are high risk investments.

Doing your crypto-dough

For one thing, cryptocurrencies are hard to trace. That makes them perfect for tax evasion, money laundering and criminal transactions taking place on the ‘dark net’. Unsurprisingly, national governments have been at best suspicious and at worst antagonistic to them. That hasn’t prevented them from gaining traction. Nonetheless, it would only take a handful of major economies mobilising against them (as China has several times) for their value to tumble.

Unlike the traditional money overseen by central banks and governments answerable to those they govern, cryptocurrencies are at the mercy of the individuals who have developed them. While it hasn’t happened in any notable way yet, it’s not hard to imagine a scenario where those developers manipulate the currency, possibly by flooding the market to enrich themselves.

Finally, and perhaps most persuasively, cryptocurrencies run all the same security risks as anything internet related. Cybercriminals could steal your cryptocurrency; hackers can and have hacked cryptocurrencies and online exchanges can and have shut down leaving their customers out of pocket. In such circumstances, there’s unlikely to be a financial institution, law enforcement agency or regulatory body to provide recourse.

All these issues with cryptocurrencies may ultimately be addressed. They may end up being an asset class worthy of serious consideration. But for the time being, they remain a higher risk investment.

Monthly Fund Profile: PIMCO Income Fund

What does it invest in?

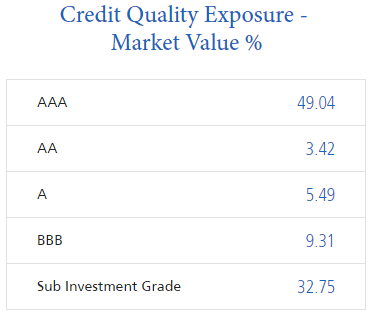

The PIMCO Income fund is a portfolio that is actively managed and invests in a broad range of fixed income securities to maximise current income while maintaining a relatively low risk profile, with a secondary goal of capital appreciation. The fund taps into multiple areas of the global bond market, and employs PIMCO’s vast analytical capabilities and sector expertise to help temper the risks of high income investing.

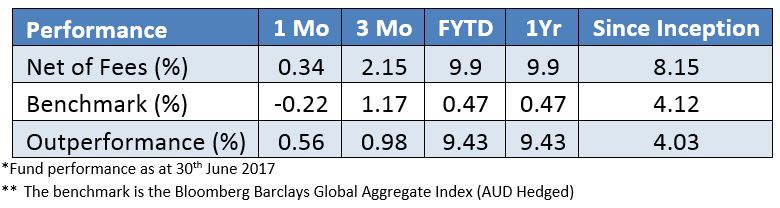

What is its performance?

Potential benefits to your portfolio

The aim of the fund is to provide a competitive and consistent level of income without compromising total return, and has also been designed to provide liquidity when needed. The fund achieves this through its multi-sector approach which allows it to seek out the best income-generating ideas in any market climate, targeting multiple sources of income from a global opportunity set.

The PIMCO Income Fund can be considered as a ‘satellite’ credit fund that can potentially deliver a higher rate of return than the traditional bond funds in a client’s portfolio.

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

EFDB Pty Ltd | Sydney CBD | Northern Beaches | ABN 64 112 871 922 | AFSL 311720

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)