2020 August Newsletter

August is here and the wattle is in bloom, a sign that spring is around the corner. Australians will all be hoping for brighter days ahead, as we contend with rising COVID cases and sobering news on the economic front.

After postponing the Federal Budget until October due to COVID, the government released a budget update on July 23 which gave an insight into the economic impact of the health crisis. It estimates a budget deficit of $85.8 billion in 2019-20 (4.3% of GDP) rising to $184.5 billion in 2020-21 (9.7% of GDP). This would be the biggest deficit as a share of GDP since 1946 in the aftermath of WWII. The economy contracted an estimated 0.25% in 2019-20, with a further fall of 2.5% in 2020-21, the first consecutive annual falls in over 70 years.

Unemployment rose from 7.1% to 7.4% in June, the highest in almost 22 years. The jobless rate is expected to peak at around 9% in December before it begins to fall. As a result of the economic slowdown, inflation fell 1.9% in the June quarter (minus 0.3% on an annual basis), the biggest quarterly fall since 1931 during the Depression. The biggest price falls were for childcare, petrol, primary education, and rents. This was reflected in falling consumer confidence, with the ANZ-Roy Morgan confidence rating falling to a 13-week low of 89 late in the month (the long-term average is 112.8 points).

On financial markets, gold rose to a record high of US$1975 an ounce in July, reflecting its role as a defensive asset in difficult times. Crude oil prices inched up 1% in July but are down 25% over the year. And in good news for Australian exports, iron ore prices rebounded 8% in July (down 7% for the year). The Australian dollar continued to climb, closing the month above US72c.

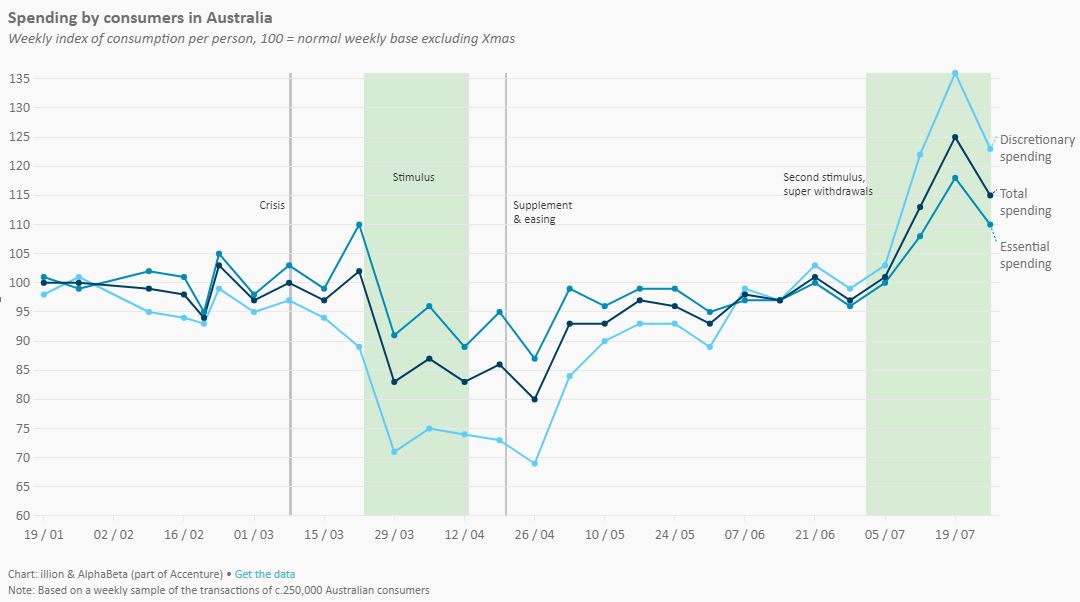

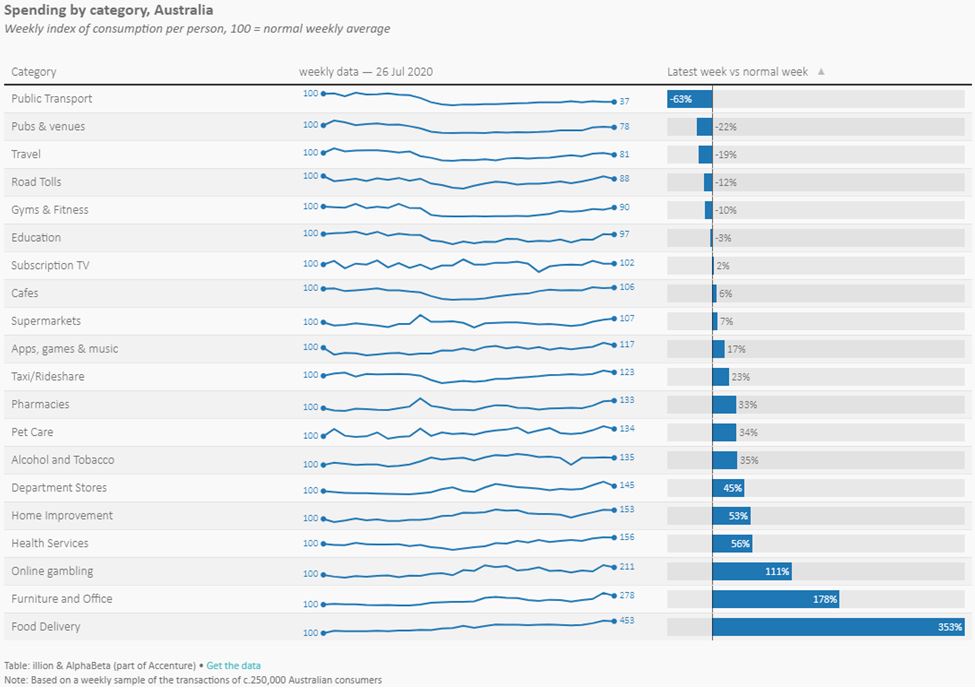

Spending insights during COVID19

This page provides weekly data on the impact of COVID19 on the Australian economy. The information is provided by leading credit bureau, illion, in partnership with economists at AlphaBeta. This research is sourced from customer-consented anonymised data used by illion to undertake research, analysis and product development. The data has been weighted to the Australian census to account for population biases.

The data shows interesting insight in the performance of the different sectors of the economy following COVID19.

Super changes add flexibility

Here’s a summary of the new rules.

Work test to kick in at 67

Under changes to the work test, if you are aged 65 or 66 you can now put money into super even if you aren’t working. This gives people flexibility to make voluntary catch-up contributions for a few more years and give their retirement savings a last-minute boost.Under the work test, which now kicks in at age 67, you must work at least 40 hours within 30 consecutive days in the financial year in which you make the contribution.

It was also proposed to allow people aged 65 and 66 at the start of the financial year to use the existing non-concessional bring forward rules. If eligible, this allows you to ‘bring forward’ up to three years’ worth of non-concessional contributions (up to $300,000) in the current financial year. Legislation must be passed before this proposal becomes effective.

Couples get a super boost

Couples also have more flexibility to grow their retirement savings later in life, thanks to recent changes to spouse contributions. As of 1 July 2020, you can contribute to your spouse’s super fund until they reach age 75, up from the previous age limit of 70.What’s more, if your spouse (married or de facto) earns less than $37,000 you may be able to claim a tax offset of up to $540 for your contribution to their super. The offset phases out once your partner’s income reaches $40,000.

The usual non-concessional contribution limits still apply, and the receiving spouse still needs to meet the work test where applicable.

Super pension drawdowns halved

Retirees whose superannuation has taken a hit from the COVID-19 market volatility have also been given a bit more wriggle room this financial year. The government has temporarily halved the minimum amount retirees must withdraw each financial year from their account-based super pension.This temporary measure will help retirees who might otherwise have to sell assets at depressed prices to provide cash for their pension payments.

For example, someone aged 65 would normally be required to withdraw 5 per cent of their super pension account balance each financial year. But in 2020-21 they need only withdraw 2.5 per cent of their account balance if they wish. There’s no maximum withdrawal rate.

Early release of super

Younger super fund members have not been forgotten. You can withdraw up to $10,000 from your super account this financial year if you are suffering financial hardship due to the economic impact of COVID-19. This is in addition to the $10,000 you could withdraw last financial year.It must be stressed though, that the early withdrawal of your super should be a last resort because of the adverse impact on your retirement savings. An amount of $10,000 withdrawn early in your working life could potentially be worth many times that by the time you retire.

If, after weighing up your financial options, you wish to take advantage of this temporary measure then you need to apply by 24 September 2020.

Super guarantee amnesty for employers

If you run your own business and you have taken your eye off the ball when it comes to paying the correct amount of super to your employees, then the Australian Taxation Office (ATO) is offering a temporary amnesty to set things right.You have until 7 September 2020 to disclose and pay any unpaid Super Guarantee (SG) amounts for your employees. These contribution shortfalls can be from any quarter from 1 July 1992 to 31 March 2018.

Under the amnesty, you will not have to pay the administration charge or Part 7 penalty (up to 200 per cent of the Superannuation Guarantee Charge). You can also claim a tax deduction for your payments.

If you would like more information about any of these changes or how to take advantage of them, give us a call.

Watching our online and social spending

With the average Australian spending over six hours on social media every week, it’s safe to say we’re affected by what we consume online.i This can happen consciously, from actively looking up brands and products, or subconsciously, through viewing advertisements directed at us.

Social networking to selling

When Facebook first started gaining popularity in the noughties, its focus was on social networking. By 2016 it had evolved into a marketplace so users could sell to each other, regardless of whether they were connected. Facebook also had over seven million advertisers during the third quarter of 2019 alone.ii So when you log into your Facebook account these days, it’s just as likely to be because you’ll buy something than to socialise.Similarly, Instagram has developed from simply sharing photos. A 2019 survey showed that 81% of respondents use their accounts to research products and services, and 130 million users view shopping posts every month.iii,iv

Easy social shopping

The sophisticated and seamless purchasing experience offered by social media platforms has made shopping even easier and buy now, pay later services such as Afterpay also make it easier to purchase an online product or service through instalments.Hard to resist targeted advertising

While users are able to search for products and purchase online, the data collected from social platforms allows marketers to target individuals based on their demographics, interests and online behaviour. Have a look at the ads that appear when you next log in – chances are they’ll be relevant to you. Your data, such as your browsing history and the apps you use, can be tracked and used to present targeted advertising on your feeds.v This practise isn’t a secret, but it can still be surprising (and even unsettling) as to how tailored this advertising can be. With advertising pinpointing your real and anticipated needs, it can be hard to resist buying. And with data kept of previous ads you responded to, you’ll see even more similar ads after you purchase from an ad – keeping you in the spending loop.Influencing our buying behaviours

‘Keeping Up With The Joneses’ is prevalent on social media, where people compete for the most likes thanks to their extravagant lifestyles. But it’s not just envy which induces us to spend. We turn to those we trust when it comes to making decisions, which is why when we see friends, families and ‘influencers’ (people we respect and trust) using a product or service and having a positive experience, this acts as social proof.Fear Of Missing Out

FOMO – it’s a thing, and something that can be worsened by social media, making it tempting to spend on the latest gadgets or lifestyle trends. Comparing yourself to others can create anxiety and also induce spending to ‘keep up’. However, there’s a growing movement towards JOMO, the joy of missing out.With financial anxiety on the rise, JOMO is much better for our hip pocket than FOMO.vi

Watching your hip pocket when it comes to your social spend can be challenging. If you are concerned about your spending, set a budget which allows for the amount of online shopping you are comfortable with. It’s a good idea to keep track of your purchases to ensure your spending is not to the detriment of your day to day needs as well as your longer-term financial goals.

Finally, just having a greater awareness of how social media influences your behaviour will help you to resist the subtle enticements of social marketing.

i https://www.genroe.com/blog/social-media-statisticsaustralia/13492

ii https://sproutsocial.com/insights/social-media-statistics/

iii https://business.instagram.com/blog/how-to-sell-yourproducts-on-instagram/

iv https://blog.hootsuite.com/instagram-statistics/

v https://www.wired.com/story/whats-not-included-infacebooks-download-your-data/

vi https://www.news.com.au/finance/economy/australianeconomy/younger-australians-are-embracing-the-joy-ofmissing-out-as-financial-anxiety-takes-its-toll/news-stor y/11ac6520fa3be768d885b855ae0c8c76

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

EFDB Pty Ltd | Sydney CBD | Northern Beaches | ABN 64 112 871 922 | AFSL 311720

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)