2020 October Newsletter

October is here and it’s shaping up to be a busy month. Many of us took advantage of the October long weekend and school holidays for a much-needed staycation in our home states, while Melbourne has announced a further easing of restrictions.

Also announced was the most important Federal Budgets in living memory, after COVID-19 delayed the usual May delivery to October 6. In September it was confirmed that Australia is in recession. The economy contracted 7% in the June quarter following the 0.3% fall in the March quarter, taking the annual decline to 6.3%, the biggest since 1945. The pandemic has also hit the federal budget bottom line, with a budget deficit of $85.3 billion in the 2019/20 financial year. The biggest government stimulus program since WWII took net government debt to $491 billion, or 24.8% of GDP, with more spending on the cards.

Against this backdrop, there is mounting speculation that the Reserve Bank could cut the cash rate as early as next week, from its current record low of 0.25%, to help stimulate the economy. A rise in the Aussie dollar could tip the balance. The dollar ended September around US71.5c, down 2c over the month, after dipping as low as US70c.

On a positive note, the ANZ-Roy Morgan consumer confidence index rose for four weeks straight in September, to a 14-week high of 95 points (although still 19.7 points lower than a year ago). The NAB business confidence index also improved, from -14.2 points to -8.0 points in August. Unemployment is also headed in the right direction, down from a 22-year high of 7.5% to 6.8% in August.

Federal Budget 2020-21 Analysis

Building a bridge to recovery

In what has been billed as one of the most important budgets since the Great Depression, and the first since the onset of the COVID-19 pandemic dragged Australia into its first recession in almost 30 years, Treasurer Josh Frydenberg said the next phase of the journey is to secure Australia’s future.

As expected, the focus is on job creation, tax cuts and targeted spending to get the economy over the COVID-19 hump.

The Treasurer said this Budget, which was delayed six months due to the pandemic, is “all about helping those who are out of a job get into a job and helping those who are in work, stay in work”.

The big picture

After coming within a whisker of balancing the budget at the end of 2019, the Treasurer revealed the budget deficit is now projected to blow out to $213.7 billion this financial year, or 11 per cent of GDP, the biggest deficit in 75 years.

With official interest rates at a record low of 0.25 per cent, the Reserve Bank has little firepower left to stimulate the economy. That puts the onus on Government spending to get the economy moving, fortunately at extremely favourable borrowing rates. And that is just as well, because debt and deficit will be with us well into the decade.

The Government forecasts the deficit will fall to $66.9 billion by 2023-24. Net debt is expected to hit $703 billion this financial year, or 36 per cent of GDP, dwarfing the $85.3 billion debt last financial year. Debt is expected to peak at $966 billion, or 44 per cent of GDP, by June 2024.

The figures are eye-watering, but the Government is determined to do what it takes to keep Australians in jobs and grow our way out of recession.

So, what does the Budget mean for you, your family and your community?

It’s all about jobs

With young people bearing the brunt of COVID-related job losses, the Government is pulling out all stops to get young people into jobs. Youth unemployment currently stands at 14.3 per cent, more than twice the overall jobless rate of 6.8 per cent.

As we transition away from the JobKeeper and JobSeeker subsidies, the Government announced more than $6 billion in new spending which it estimates will help create 450,000 jobs for young people.

“Having a job means more than earning an income,” Mr Frydenberg said.

Measures include:

- A new JobMaker program worth $4 billion by 2022-23, under which employers who fill new jobs with young workers who are unemployed or studying will receive a hiring credit of up to $10,400 over the next year. Employers who hire someone under 29 will receive $200 a week, and $100 a week for those aged 30-35. New employees must work at least 20 hours a week to be eligible.

- A $1.2 billion program to pay half the salary of up to 100,000 new apprentices and trainees taken on by businesses.

In recognition that the pandemic has had a disproportionate impact on women’s employment, the Budget includes the promised “Women’s economic security statement” but the size of the support package may disappoint some.

Just over $240 million has been allocated to “create more opportunities and choices for women” in science, technology, engineering and mathematics (STEM) as well as male-dominated industries and business.

Housing and infrastructure

As part of its job creation strategy, the government also announced $14 billion in new and accelerated infrastructure projects since the onset of COVID.

The projects will be in all states and territories and include major road and rail projects, smaller shovel-ready road safety projects, as well as new water infrastructure such as dams, weirs and pipelines.

The construction industry will also be supported by the first home loan deposit scheme being extended to an extra 10,000 new or newly built homes in 2020-21. This scheme allows first home owners to buy with a deposit as low as 5 per cent and the Government will guaranteeing up to 15 per cent.

Personal tax cuts

As widely tipped, the government will follow up last year’s tax cut by bringing forward stage two of its planned tax cuts and back date them to July 1 this year to give mostly low and middle-income taxpayers an immediate boost.

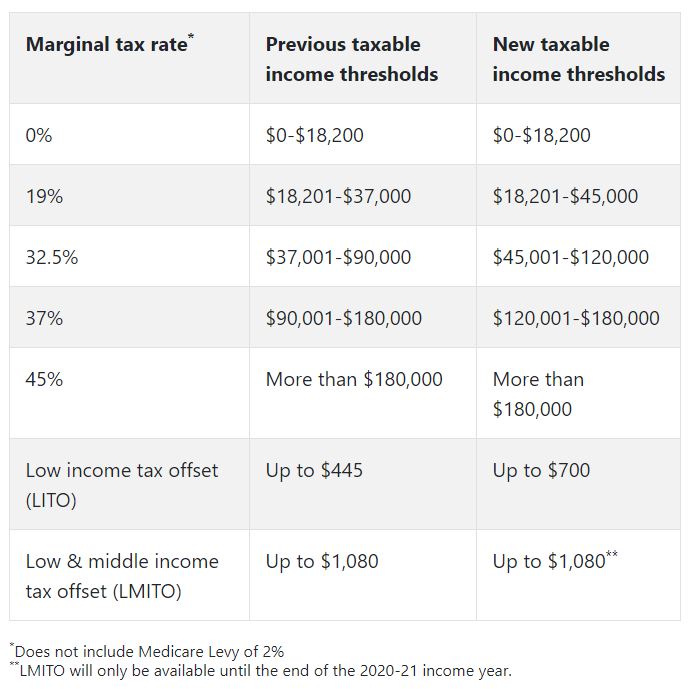

As the table below shows, the upper income threshold for the 19 per cent marginal tax rate will increase from $37,000 a year to $45,000 a year. The upper threshold for the 32.5 per cent tax bracket will increase from $90,000 to $120,000.

As a result, more than 11 million Australians will save between $87 and $2,745 this financial year. Couples will save up to $5,490.

You don’t need to do anything to receive the tax cuts. The Australian Taxation Office (ATO) will automatically adjust the tax tables it applies to businesses and simply take less. It will also account for three months of taxes already paid from 1 July this year so workers can catch up on missed savings.

Business tax relief

In another move that will help protect jobs in the hard-hit small business sector, business owners will also get tax relief through loss carry back provisions for struggling firms. This will allow them to claim back a rebate on tax they have previously paid until they get back on their feet.

Businesses with turnover of up to $5 billion a year will be able to write off the full value of any depreciable asset they buy before June 2022.

Cash boost for retirees

Around 2.5 million pensioners will get extra help to make up for the traditional September rise in the Age Pension not going ahead this year. However, self-funded retirees may feel they have been left out.

Age pensioners and as well as people on the disability support pension, Veterans pension, Commonwealth Seniors Health Card holders and recipients of Family Tax Benefit will receive two payments of $250 from December and from March.

This is in addition to two previous payments of $750 earlier this year.

Health and aged care

After the terrible toll the pandemic has waged on aged care residents and the elderly, the Government will add 23,000 additional Home Care packages to allow senior Australians to remain in their home for as long as possible.

Funding for mental health and suicide prevention will also be increased by $5.7 billion this year, with a doubling of Medicare-funded places for psychological services.

Super funds on notice

Underperforming super funds are to be named and shamed with a new comparison tool called Your Super. This will allow super members to compare fees and returns.

All funds will be required to undergo an annual performance test from 2021 and underperforming funds will be banned from taking on new members unless they do better.

Looking ahead

As the underlying Budget assumptions are based on finding a coronavirus vaccine sometime next year, Government projections for economic growth, jobs and debt are necessarily best estimates only.

Only time will tell if Budget spending and other incentives will be enough to encourage business to invest and employ, and to prevent the economy dipping further as JobKeeper and JobSeeker temporary support payments are wound back.

Another test will be whether the Budget initiatives help those most affected by the recession, notably young people and women.

The Government has said it is prepared to consider more spending to get the economy out of recession. The Treasurer will have another opportunity to fine tune his economic strategy fairly soon, with the next federal budget due in just seven months, in May 2021.

If you have any questions about any of the Budget measures and how they might impact your finances, don’t hesitate to contact us.

Information in this article has been sourced from the Budget Speech 2020-21 and Federal Budget support documents.

It is important to note that the policies outlined in this publication are yet to be passed as legislation and therefore may be subject to change.

Algorithms driving our narrowing focus

There’s no doubt we live in a curated world. Online algorithms serve up content designed to meet our needs based on what we’ve liked and engaged with in the past. And while this can help us find what we’re looking for, the problem is that while these algorithms reflect our interests, they also reinforce them.

There’s no doubt we live in a curated world. Online algorithms serve up content designed to meet our needs based on what we’ve liked and engaged with in the past. And while this can help us find what we’re looking for, the problem is that while these algorithms reflect our interests, they also reinforce them.As a result we see little of what’s different and unfamiliar - our beliefs are unchallenged and our biases strengthened.

Thankfully with a little awareness we can break out of our respective bubbles and gain a fresh perspective.

The impact of online algorithms

Online algorithms can save us time searching for the information we are after. They can seemingly anticipate our needs before we even know we have them, for instance, presenting us with an ad for contact lens refills just before you run out, or a reminder to get a health check based on your age and gender.Yet there is a more serious impact as well, as evident in The Wall Street Journal’s 2016 US politics experiment where they created a blue (liberal) and red (conservative) Facebook feed side-by-side.i This illustrated just how dissimilar reality is for different Facebook users, and offered a rare side-by-side look at real conversations from different perspectives.

Algorithms can reinforce biases, which Amazon discovered when its hiring tool chose candidates based on their use of certain phrases more commonly associated with men.ii This lack of gender-neutrality in hiring meant that female candidates would miss on opportunities due to the system’s algorithm.

Being aware

Back in 2015, a study found that 62.5% of respondents were unaware that Facebook curated its news feed to present content based on user’s interests.iii These ‘filter bubbles’ have since been identified as problematic, with Bill Gates speaking out about them several years ago.iv Living in these bubbles makes it easy to forget that not everyone thinks the way we do, which can increase polarisation.We now have a better grasp of the powers of algorithms and how they can warp our online experiences. This awareness means we can more critically think about what we are presented with and look beyond our feeds to see what other views and opinions are out there.

Broaden your horizons

While our online experience may be narrowing our world view, if approached mindfully it can also provide access to an incredible range of social groups, conversations and opinions that may challenge our preconceived notions and broaden our horizons, if we seek them out.Read and watch a variety of news sources rather than just your one media outlet of choice. Try to access and appreciate both sides of an issue. Procon.org can help you there, as it presents opposing arguments to controversial issues. You can click on the ‘more issues’ tab to read through different takes on everything from politics and society, science and technology, health and medicine, and education. Each topic is split into pros and cons so you can decide for yourself what you believe after weighing up the arguments – perhaps you might even change your mind on some issues!

Technology firms have even developed tools that adjust your ‘filter bubbles’ via sliders that control content filters.v For instance, the “politics” slider ranges from “my perspective” to “lots of perspectives.” Choosing the latter end provides access to media outlets that would not normally be displayed in your feed.

Then there are apps like Earbits, which allow users to discover new music by clicking on different genres, as opposed to music platforms that recognise your preferences and serve up more of what you already like.

It’s about choosing to be active, curious and explorative in your online travels. After all, being exposed to new ideas is at the heart of learning, understanding and personal growth so resist going down that narrowing information highway.

i http://graphics.wsj.com/blue-feed-red-feed/

ii https://www.reuters.com/article/us-amazon-com-jobs-automation-insight/amazon-scraps-secret-ai-recruiting-tool-that-showed-bias-against-women-idUSKCN1MK08G

iii http://www-personal.umich.edu/~csandvig/research/Eslami_Algorithms_CHI15.pdf

iv https://qz.com/913114/bill-gates-says-filter-bubbles-are-a-serious-problem-with-news/

v https://www.media.mit.edu/projects/gobo/overview/

Managing investment risk in uncertain times

the global economy and investment markets remains uncertain until an effective vaccine is available.

the global economy and investment markets remains uncertain until an effective vaccine is available.While there is cause for optimism that one of the many vaccines will become available in the not-too-distant future, the road to financial recovery – for nations and many individuals – could be much longer.

Whether you are working towards major financial goals such as buying a home, planning to retire soon, or already retired and looking for reliable income, it’s never been more important to come to terms with uncertainty and manage investment risk.

So how can investors not only survive, but thrive, during this difficult period? Staying the course isn’t easy when you can’t see what lies ahead, but you need to strap yourself in if you want to achieve long-term financial success.

Stay the course

When markets fall sharply, as the sharemarket did earlier this year, it’s tempting to switch to cash investments. All too often, this can mean you lock in your losses at or near the bottom of the market and potentially miss out on the recovery that follows.After hitting a record high in February, the ASX 200 fell almost 37 per cent by mid-March as the economic impacts of COVID-19 began to sink in. Then against expectations, the market rebounded 35 per cent over the next three months.i

Throughout that period, volatility was high with dips of a few percent one day followed by an equally sharp rise the next. But history has shown that it generally pays to ignore the noise.

There have been many studies about the impact of missing out on the best days for a market over a given period. Missing even a few of these days can have a big impact on your long-term returns.

Looking at the Australian market, a hypothetical $10,000 invested in the ASX 200 Accumulation Index (share prices plus dividends) on 30 October 2003 would have turned into $37,735 by 6 September 2020. Missing the 10 best days would have reduced returns by $15,375, while missing the 20 best days would have reduced returns by $22,930.ii

Manage investment risks

While it’s important to stay invested, that doesn’t mean you should forever sit on your hands and do nothing.Booming markets can make investors complacent, so a market correction is often a good opportunity to stress test your investments to see if they are appropriate for risk tolerance and personal circumstances.

For example, if you’re in your super fund’s growth option but this year’s roller-coaster markets have kept you awake at night, then perhaps a more conservation option would be more appropriate.

Or if your portfolio has become unbalanced after all the market upheaval, with too much reliance on one asset class or market sector, then you might think about rebalancing your portfolio to plug any gaps.

Investors who are nearing retirement or recently retired may have a greater focus on preserving capital, to provide more certainty that their money won’t run out.

The importance of diversification

Yet even retirees need to balance their need for capital preservation with capital growth, which is another way of saying they still need to diversify their investments.By diversifying across and within asset classes, you have the best chance of riding out a big fall in any one asset class. With interest rates close to zero and likely to stay low for some time, investments such as bonds and cash that traditionally provide capital protection with regular income will be hard-pressed to keep pace with inflation.

By including some growth assets such as shares and property in your portfolio, your savings will continue to grow over the long term even as you draw down income to cover your living expenses. Shares and property also provide income in the form of dividends and rent, which retirees can use to diversify their sources of income.

Whatever your age and stage of life, avoiding knee jerk reactions, managing risk and diversification can help you navigate these uncertain times. If you would like to discuss your investment strategy, please get in touch.

i https://www.asx.com.au/prices/charting/index.html

ii https://www.fidelity.com.au/learning-hub/markets/timing-the-market/

Life cover: More essential than ever

Living through COVID-19 has brought many challenges and shifting priorities as we deal with the financial impacts of the pandemic, and that includes the issue of life insurance.

Living through COVID-19 has brought many challenges and shifting priorities as we deal with the financial impacts of the pandemic, and that includes the issue of life insurance.On the one hand, the pandemic has highlighted the importance of life cover. On the other, those who may have lost a job or lost income are questioning its necessity.

Many Australians continue to view life insurance as a discretionary item. This is in stark contrast to car or home insurance which are seen as necessities. It seems we are willing to insure our property but not the thing that matters most – our life and our ability to earn an income.

Conflicting priorities

A survey by KPMG found that only 35 per cent of Australians thought life insurance was essential and just 30 per cent believed they needed income protection. But when it comes to car insurance, 79 per cent viewed cover as essential and yet, during COVID-19, car usage reduced as many were working from home and restricting their movements.As the COVID-19 health crisis has reinforced our vulnerability in terms of health and the fragility of life, the need for life and income protection insurance has probably never been greater.

What would happen if you became too sick to return to work or if you passed away? Who would pay the mortgage, living costs, health insurance and utility bills for you or the family you left behind? For those with outstanding debt and dependants, life insurance will always be an important consideration.

It should also be remembered that the current health crisis does not rule out people getting sick with other illnesses, some linked to COVID-19 and some not. Mental health is one these health issues and is becoming increasingly prevalent.

Claims on the rise

In the June quarter, the life insurance industry reported a net after-tax loss of $179 million on its individual income protection products, driven largely by claims for mental health issues in the wake of COVID-19.i Mental health claims are expected to grow even further as it is thought most people take more than a year to report such issues.With claims on the uptick, this has meant the insurance industry is either looking to increase premiums or already has. This, in turn, may discourage people from keeping their cover.

Indeed, the KPMG survey said that 38 per cent of policy holders were looking to cancel their income protection insurance in the next 12 months, and 25 per cent were planning to drop life cover.

On the plus side, many Australians have some level of life and income protection insurance in their super. However, if you were to lose your job, then paying premiums on your insurance in super would come out of your fund balance, reducing your retirement savings over time.

Also, your insurance might well cease when you lose your job unless you opt to take out a private policy. You generally have 60 days to take up this option.

Redundancy payments

If your income protection insurance is outside super, then be mindful that not all policies include redundancy claims. And those that do may have restrictions. For instance, there is usually a wait period of up to 28 days before any payments will be made.If you are thinking of taking out a policy now to cover you in case of redundancy given the current economic environment, then you will probably have to go through a six-month no-claim period before you can benefit. During that six-month period, there must be no indication from your employer that redundancy may be on the cards.

Many insurance companies recognise the financial and personal difficulties many people currently face and some have offered to reduce or even suspend premiums without any loss of continuity to your policy.

One alternative may be to look at reducing the cover you have so that your premiums reduce. But it’s important to be mindful of your needs and ensure you have adequate cover.

The road ahead

The insurance industry, like many others, is being forced to look at a different way of doing business in a post-COVID-19 world, with simpler policies and flat premiums all being discussed.In the meantime, making quick decisions on whether you still need insurance, or your current level of insurance, may prove a mistake. If you are thinking about altering your cover, give us a call first to discuss your insurance needs.

Matters of Interest

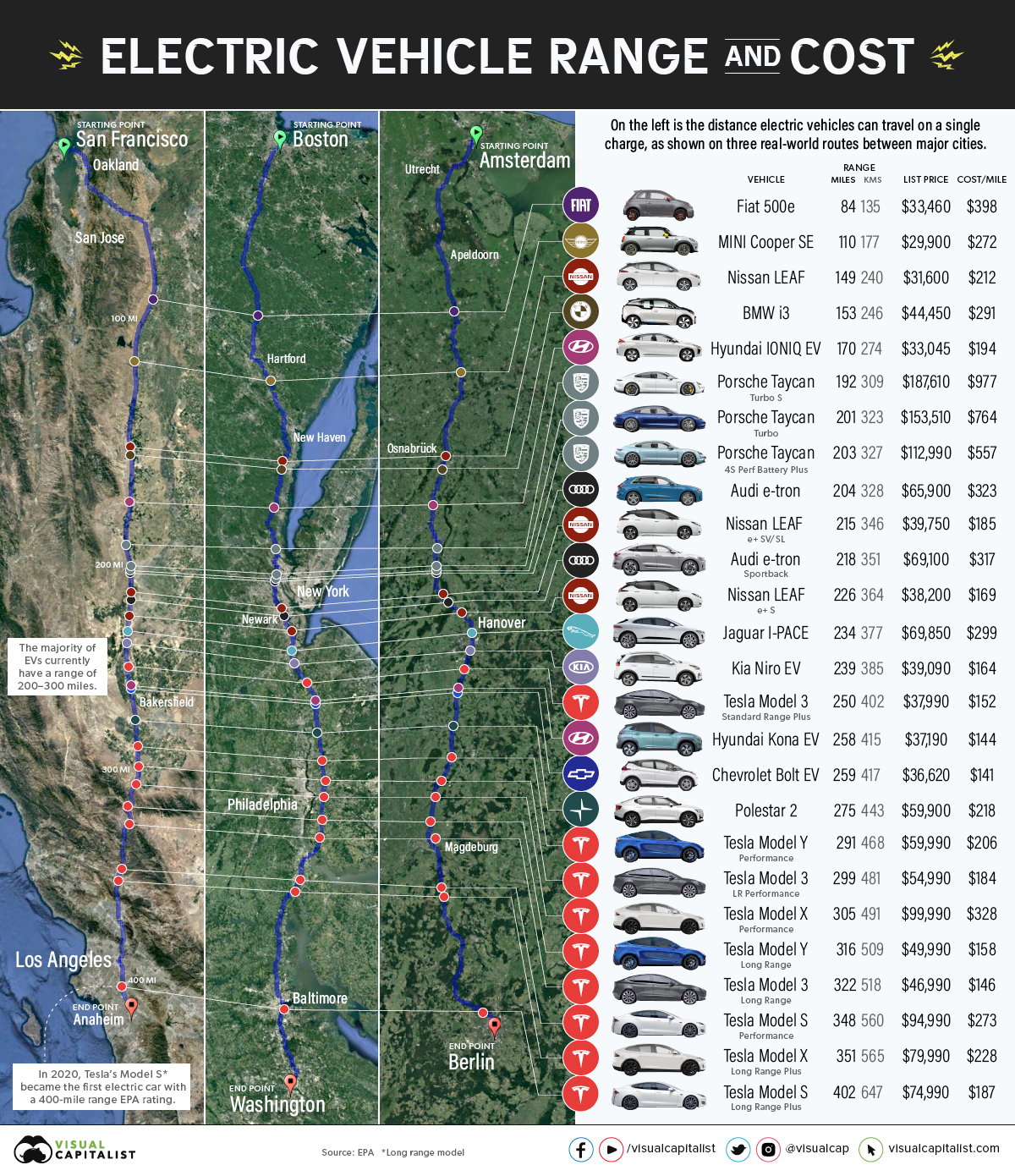

The following diagram from Visual Capitalist illustrates how Tesla is currently dominating the Electric Vehicle (EV) race.

Reference : https://www.visualcapitalist.com/range-evs-major-highway-routes/

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)