Coronavirus safety net expanded. What does it mean for you?

In a rapidly evolving response to the spread of COVID-19, the Federal Government’s second support package announced over the weekend has flicked the switch to more income support for retirees and workers.

Between the first $17.6 billion package announced on March 12, and this latest $66.1 billion package, the emphasis has shifted from stimulus aimed at keeping businesses up and running, to support for individuals to get them through the crisis.

Importantly, casuals and sole traders along with employees who lose work due to the coronavirus shutdown will receive help.

Retirees affected by falling superannuation balances and deeming rates out of line with historically low interest rates have also been offered some reprieve.

Minimum pension drawdowns halved

Self-funded retirees will be relieved the Government has moved quickly to temporarily reduce the minimum drawdown rates for superannuation pensions.

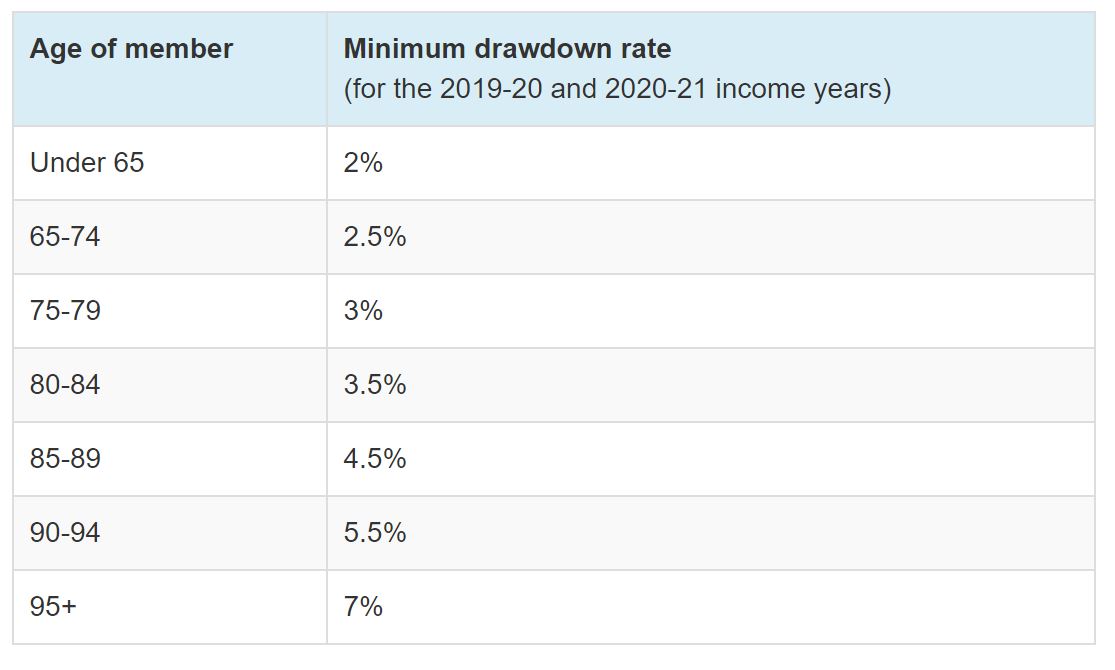

Similar to the response in the wake of the Global Financial Crisis, minimum drawdown rates for account-based pensions and similar products will be halved for the 2020 and 2021 financial years.

This means retirees will be under less pressure to sell shares or other pension assets in a falling market to meet the minimum payments they are required to withdraw each financial year. For example, a 75-year-old retiree will now be required to withdraw a minimum of 3 per cent of their super pension balance this financial year and in 2020-21, instead of the usual 6 per cent.

The new rates are in the table below:

Deeming rates cut again

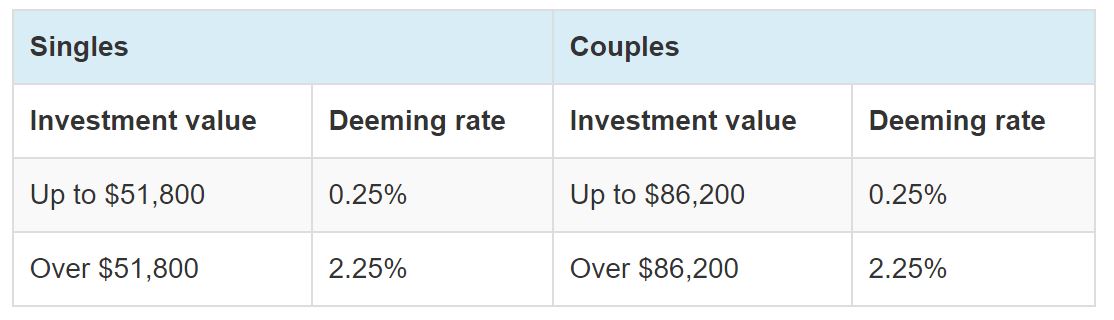

In addition to the cut in pension deeming rates announced in the first stimulus package, the Government has cut deeming rates by a further 0.25 percentage points. This reflects the Reserve Banks latest cut in official interest rates to a new low of 0.25 per cent.

Deeming rates are the amount the Government ‘deems’ pensioners earn on their investments to determine eligibility for the Age Pension and other entitlements, even if that rate is lower than they actually earn.

This move will bring deeming rates closer in line with the interest rates pensioners are receiving on their bank deposits, especially those with lower balances.

From 1 May 2020, deeming rates will fall to 0.25 per cent on investments up to $51,800 for singles and $86,200 for couples. A rate of 2.25 per cent will apply to amounts above these thresholds (see table).

Early access to super

More controversially, the Government has also announced it will allow anyone made redundant because of the coronavirus, or had their hours cut by more than 20 per cent, to withdraw up to $10,000 from their super this financial year and a further $10,000 in 2020-21.

Sole traders who lose 20 per cent or more of their revenue due to the coronavirus will also be eligible.

The Treasurer said the process is designed to be frictionless, with eligible individuals able to apply online through MyGov rather than going to their super fund.

While this provides an additional safety net for individuals and families who face the loss of a job or a significant fall in income, we do urge our clients to consider accessing their super as a last resort.

Taking a chunk out of your retirement savings now, after a big market fall, would not only crystallise your recent losses but it also means you would have less money working for you when markets recover.

So before you do anything, speak to us and look at other income support measures.

Relief for those out of work

All workers, including casuals and sole traders, who lose their job or are stood down due to the coronavirus shutdown, will be eligible for a temporary expansion of Newstart (now called JobSeeker) payments to new and existing recipients.

Individuals who meet the income test will receive a coronavirus supplement of $550 a fortnight on top of their existing payment for the next six months. This means anyone eligible for JobSeeker payments will receive approximately $1100 a fortnight, effectively doubling the allowance.

This measure includes people on Youth Allowance, Parenting Payment, Farm Household Allowance and Special Benefit.

Importantly, the extra $550 will go to all recipients, including those who get much less than current maximum fortnightly payment because they have assets or have found a few hours of part-time work.

Support for pensioners

Pensioners have also received additional support. On top of the $750 payment announced on March 12, an additional $750 will be paid to any eligible recipients, as at 10 July 2020, receiving the Age Pension, Veterans Pension or eligible concession card holders.

This payment will be made automatically from 13 July 2020.

Support for businesses

The Australian Government is supporting Australian businesses to manage cash flow challenges and retain employees. Assistance includes cash flow support to businesses and temporary measures to provide relief for financially distressed businesses.

- Funding support for small businesses and not for profits who are continuing to pay employees. This applies to entities with aggregate annual turnover of under $50 Million, who employ workers and will take the form of a reimbursement of up to 100% of salary and wages tax withholdings, with a minimum payment of $10,000 and a maximum of $50,000. It seems that there will be one payment from 28 April 2020 and a further payment made from 28 July 2020. These payments will be tax free.

- The Government will establish a scheme to guarantee 50% of new loans to SMEs, up to a maximum of $40 Billion. This is in addition to the $90 Billion of funding being made available by the Reserve Bank to Australian Banks.

- Temporary relief for distressed businesses, involving an increase in the threshold for creditor action and a delay in the timeframe to respond. Further protections will be made available to directors.

More support to come

This latest support package is unlikely to be the last as the Government responds to a rapidly evolving health crisis and progressive shutdown of all but essential economic activity. We will continue to monitor these and provide you with regular updates as they come.

If you have any questions about your investment strategy or entitlements to government payments, please don’t hesitate to call.

Information in this article has been sourced from https://treasury.gov.au/coronavirus/households

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

EFDB Pty Ltd | Sydney CBD | Northern Beaches | ABN 64 112 871 922 | AFSL 311720

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)