Federal Budget 2019-20 Analysis

We have summarised the key implications of the Federal Budget last night. These changes may affect you and we will take them into consideration for our future planning strategies. Please do not hesitate to contact our office if you would like to discuss any aspect of the budget.

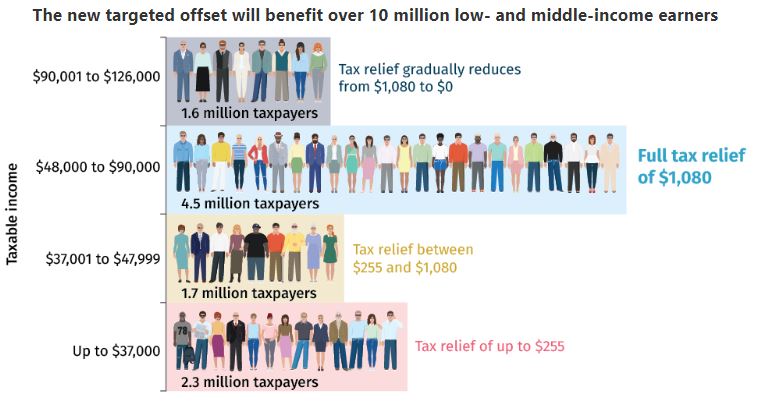

Low & Middle Income Tax Offset (LMITO)

The centerpiece of the Budget is an extension of the already announced multi-year tax package. The Low and Middle Income Tax Offset (LMITO) will almost double from $530 to a maximum of $1080 a year for people earning between $48,000 and $90,000, to be received after people submit their 2018-19 tax return. People on income below $37,000 will receive an offset of up to $255.

Source : https://www.budget.gov.au/2019-20/content/tax.htm

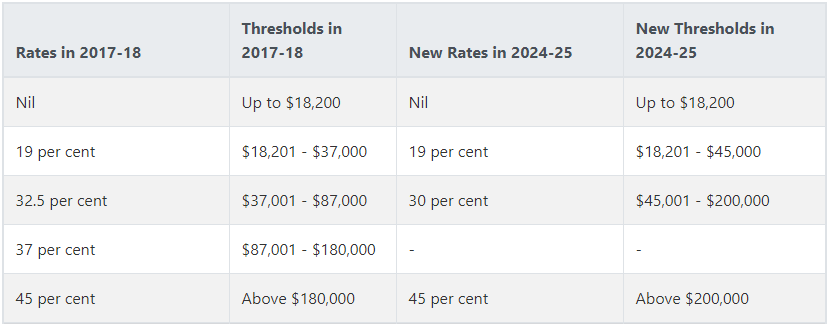

Tax Rate Changes

By 2024-25, 94 percent of taxpayers on incomes below $200,000 will pay no more than 30c tax in the dollar. Incomes above $200,000 will pay 45c in the dollar.

Medicare Levy Changes

The Government has announced they will increase the Medicare levy low-income thresholds for singles, families, seniors, and pensioners from the 2018-19 financial year. The proposed increases are marginal at best. For example, the family threshold to pay Medicare levy will increase from $37,089 to $37,764.

Superannuation Sweeteners

In a bid to help older Australians boost their retirement savings, the Government intends allowing 65 and 66-year-olds to make voluntary contributions to their super from 2020-21 without meeting the work test. Currently, people aged 65 to 74 can generally only make voluntary super contributions if they satisfy the work test. The same group will also be allowed to make three years’ voluntary non-concessional (after-tax) contributions, currently capped at $100,000 a year, in one year.

Lastly, individuals up to and including the age of 74 will be able to receive spouse contributions. Currently those aged 70 and over cannot receive spouse contributions.

Small Business Boost

Small businesses will now be able to fully write-off assets costing up to $30,000. The definition of small business has also been expanded to include businesses with revenue up to $50 million. The tax rate for companies with revenue of less than $50 million will be reduced to 25% by FY22.

OTHER MEASURES

Major Infrastructure Spending

The Government’s other signature spending initiative is a $100 billion boost to infrastructure spending over the next decade, an increase of about one third on last year’s Budget.

This includes $2 billion for a fast rail link from Melbourne to Geelong. The Government will also co-fund five business cases with state governments for fast rail from Sydney to Wollongong, Sydney to Parkes (via Bathurst and Orange), Melbourne to Albury Wodonga, Melbourne to Traralgon, and Brisbane to the Gold Coast and will build on projects already underway.

There is also a $3 billion increase (to $4 billion) in the Urban Congestion Fund, including $500 million for a commuter carpark fund.

A further $1 billion will be invested to improve the Princes Highway in NSW, Victoria and South Australia, with additional funding for road and rail projects in all states and territories.

Healthcare and Welfare

The Government has pledged $527.9 million for a Royal Commission into the abuse of people with disabilities. It has also recommitted to fully funding the National Disability Insurance Scheme, but a slow take-up of the NDIS has delivered a $1.6 billion saving to the Budget's bottom line and contributed to the projected Budget surplus.

In response to the national crisis in mental health and youth suicide, $461.1 million will go to prevention and treatment programs.

The creation of a new $337.2 million drug strategy to address harmful opioid use, improve family support services and increase the capacity of drug and alcohol services in remote and regional areas.

The cashless welfare card will be extended to all the Northern Territory and Cape York communities in Queensland at a cost of $129 million.

Aged care services will receive a further boost of $282.4 million to fund 10,000 new home care packages and increasing home care supplements for dementia and cognition.

Education

There are no big-ticket announcements for schools or universities, but $453 million will go to extend pre-school education in the year before school.

The focus instead is on a new $525.3 million skills package to provide vocational education and training that will fund 80,000 new apprenticeships and double incentives to employers to $8000 per placement.

Training hubs will be established in 10 regional areas with high youth unemployment.

Environment and Energy

The Government hopes to shore up its climate and energy credentials with $3.5 billion for a new Climate Solutions Package, including $2 billion for the Climate Solutions Fund (previously called the Emissions Reduction Fund).

Pensioners, carers and veterans will receive a one-off cash payment to help with energy bills. The Energy Assistance Payment is worth $75 for singles and $125 for couples.

It has also previously announced $1.4 billion of funding for Snowy Hydro 2.0 and $56 million for the Battery of the Nation Vision in Tasmania.

Regional communities will receive $6.3 billion in drought support and $3.3 billion in flood support. A $3.9 billion Emergency Response Fund will be set up to help with future natural disaster efforts.

National Security

There will be a continued focus on national security, with $512.8 million for the Australian Federal Police and $58.6 million to the Australian Security Intelligence Organisation.

The Government will also spend $34.8 million over four years to counter foreign interference.

Looking Ahead

This is an unusual Budget as there will be little chance of legislating most of the spending measures before a federal election in May.

The biggest risk to the Budget forecasts for growth is the falling property market and concerns that it could flow through to the broader economy. According to CoreLogic, national house prices are down 7.4 percent since their 2017 high, with most pundits predicting further falls this year.

Monetary support could come from the Reserve Bank which announced yesterday the official cash rate will remain on hold at a record low of 1.5 percent while also signaling it is prepared to cut rates this year to support growth if needed.

For its part, the Government’s proposed tax cuts and other stimulus measures could provide the kick the economy needs to get people spending, companies hiring and flat wages rising.

Labor has flagged it will deliver its own economic statement later this year if elected. We will have to wait until after the election to see whose policies will take Australia forward.

It is important to note that the policies outlined in this publication are yet to be passed as legislation and therefore may be subject to change.

Please do not hesitate to contact our office if you would like to discuss any aspect of the budget.

Please note this information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, we recommend you consider, with or without the assistance of a financial advisor, whether the information is appropriate in light of your particular needs and circumstances.

Copyright in the information contained in this site subsists under the Copyright Act 1968 (Cth) and, through international treaties, the laws of many other countries. It is owned by EFDB Pty Ltd unless otherwise stated. All rights reserved. You may download a single copy of this document and, where necessary for its use as a reference, make a single hard copy. Except as permitted under the Copyright Act 1968 (Cth) or other applicable laws, no part of this publication may be otherwise reproduced, adapted, performed in public or transmitted in any form by any process without the specific written consent of EFDB Pty Ltd.

EFDB Pty Ltd | Sydney CBD | Northern Beaches | ABN 64 112 871 922 | AFSL 311720

Categories

- Blogs (51)

- Budget (19)

- Community and Sponsorships (5)

- Cyber Security (3)

- Economic / Topical (36)

- End of Financial Year (8)

- Estate Planning (4)

- Foreign Exchange (1)

- Gifting (2)

- Health (16)

- Insurances (18)

- Investments (29)

- Lifestyle (41)

- Newsletters (55)

- Retirement (19)

- Share Buyback (1)

- Superannuation (27)

Recent Posts

Archives

- November 2022 (1)

- May 2022 (1)

- April 2022 (1)

- February 2022 (1)

- December 2021 (1)

- November 2021 (1)

- September 2021 (1)

- June 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (1)

- February 2021 (1)

- January 2021 (1)

- December 2020 (1)

- October 2020 (1)

- September 2020 (1)

- August 2020 (1)

- July 2020 (1)

- June 2020 (1)

- May 2020 (1)